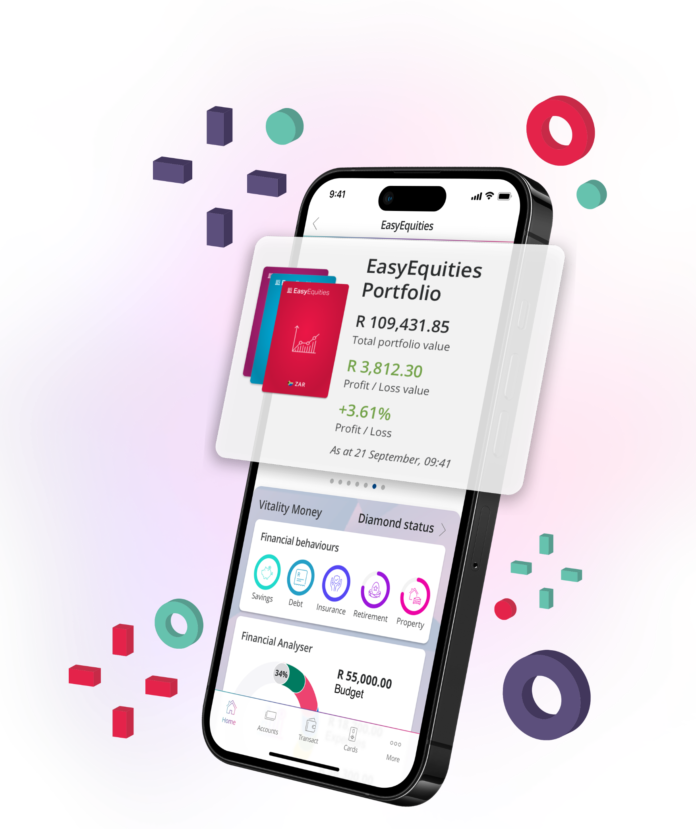

Coinciding appropriately with World Investor Week, Discovery Bank is excited to announce the launch of share trading through the Discovery Bank app, in partnership with EasyEquities. Clients can now open a new EasyEquities account, or link an existing one, seamlessly through the Discovery Bank app, making investing in their favourite local and global brands and other asset classes simple and accessible.

“The platform is transparent, easy-to-use and makes equity trading cost-effective and intuitive for all kinds of investors, from first-timers all the way through to seasoned traders. In collaboration with EasyEquities we’ve been able to make the journey to investing in equities simple and frictionless. This is all part of our focus on promoting a positive long-term savings and investment culture across our client base,” Hylton Kallner, CEO of Discovery Bank said.

Discovery Bank clients can now buy, hold and sell shares on local and international stock exchanges and access a wide range of ETFs, ETNs, as well as cryptocurrency. The integration between Discovery Bank and EasyEquities is seamless with clients being able to transfer funds between their Discovery Bank accounts and their EasyEquities ZAR account in real time, at no cost and with no lock-up periods.

“We are incredibly proud to partner with an innovative business such as Discovery Bank. To see our brand alongside Discovery Bank and to work with their incredible team is a real honour and a privilege. We look forward to delivering an exceptional “Easy” experience to their clients” Charles Savage, CEO of Purple Group said.

Discovery Bank’s shared value banking model is designed to help clients manage their money well, and EasyEquities shares the Bank’s deep conviction that saving, and investing is key to helping South Africans build wealth, empower themselves and their communities, and ultimately strengthen our economy.

Discovery Bank’s shared-value banking model is enabled through Vitality Money, an AI-Powered programme on the Discovery Bank app which gives clients an understanding of behaviours that influence their financial wellbeing and how to manage their money. The better clients do, the higher their Vitality Money status and the greater the value they receive. The EasyEquities investment portfolios integrate directly into Discovery Bank’s Vitality Money programme, automatically counting towards the client’s Vitality Money status.

“The introduction of share trading with EasyEquities is consistent with our focus on helping our clients manage their money well over the long-term – and they get rewarded immediately through the Vitality Money program for doing so,” said Kallner.

Discovery Bank has spent time designing the most seamless client experience possible, with several unique features:

– Seamless onboarding so sign up happens in minutes: Clients can open an EasyEquities account in just a few steps, without submitting any documents. Client data is already pre-populated, so it takes only a few minutes from start to finish.

– No waiting periods when depositing and withdrawing funds: Clients can transfer funds from any of their Discovery Bank transaction, credit card or demand savings accounts to their EasyEquities ZAR account in real time. The same applies for withdrawals.

– View and manage entire EasyEquities portfolios with ease: Clients can view their EasyEquities portfolio with all their other Discovery products in the banking app. They can also seamlessly buy and sell local and international shares in just a few taps.

– Trading is cost-efficient: Clients benefit from no transfer fees between their Discovery Bank account and their EasyEquities ZAR account, no minimum investment amounts, and no monthly trading account fees.